Term Insurance

Claim Settlement Ratio by IRDAI – Does it matter?

My clients usually ask me which is the best term insurance policy. What they mean is which insurance company will ensure 100% claim settlement.

The answer is none. Why?

No insurance company has a 100% claim settlement ratio and your family can bear the brunt of an unsettled claim by the insurance company.

Understand this- if an insurance company has received 50,000 insurance claims and their claim settlement ratio is 99% i.e. 49,500 claims are settled. There would still be 500 claims which would go unsettled and your claim can be one of them which can go unsettled. So, there is no way to ensure that your claim would be settled and that is the reason there is no best-term insurance policy in the market.

We often see the news regarding the Claim Settlement Ratio of Insurance Companies. Insurance Regulatory and Development Authority of India (IRDAI), the Insurance Regulator will publish the details regarding this in its annual report. While it looks like a technical insurance term, it is in our own interest to know what it means for us.

What is Claim Settlement Ratio – Meaning?

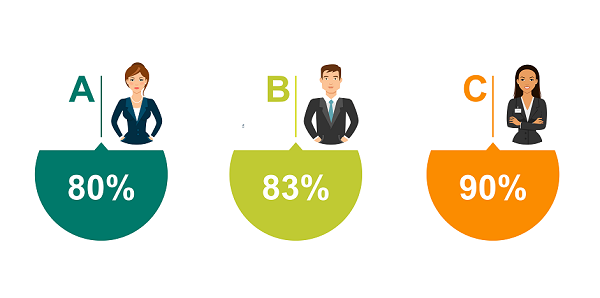

The claim settlement ratio is defined as the number of claims settled by the Insurance Company out of every 100 claims requests received by the company. If an Insurance Company received 100 claims requests in a year and the company settled 80 claims, the Claim Settlement Ratio of the company is 80%.

If an Insurance Company received 100 claims requests in a year and the company rejected 20 claims, then the Claim Rejection Ratio of the company is 80%.

IRDA divides its Claim Settlement Ratio in 3 parts

- Settled = Claims Settled/Total No. of Claims Reported* 100

- Rejected = Claims Rejected/Total No. of Claims Reported* 100

- Pending = Claims Pending/Total No. of Claims Reported* 100

IRDAI Claim settlement ratio – IRDA Annual Report

| Life Insurance Company | Claim Settlement Ratio FY 2021-2022 |

|---|---|

| Max Life | 99.34% |

| Bharti Axa Life | 99.09% |

| Exide Life | 99.09% |

| Aegon Life | 99.03% |

| Bajaj Allianz | 99.02% |

| Kotak Life | 98.82% |

| LIC | 98.74% |

| Reliance Nippon | 98.67% |

| HDFC Life | 98.66% |

| Tata AIA Life | 98.53% |

| Canara HSBC | 98.44% |

| Aviva Life | 98.39% |

| Pramerica Life | 98.30% |

| Edelweiss Tokio | 98.09% |

| Aditya Birla Sunlife | 98.07% |

| ICICI Prudential | 97.82% |

| SUD Life | 97.42% |

| PNB Met Life | 97.33% |

| Sahara Life | 97.08% |

| SBI Life | 97.05% |

| Aegas Federal | 97.03% |

| India First | 96.92% |

| Future Generali | 96.15% |

| Shriram Life | 82.39% |

IRDA Claim Settlement Ratio – What is included?

- Claim Settlement Ratio is calculated for Death Claims only

- Maturity Claims are not included in Claim Settlement Ratio

- It includes all products of Life Insurance Company whether it is a Term Plan, Endowment Plan or ULIP

- IRDA does not publish Claim Settlement Ratio of Term Insurance separately

Early Claims and Non-Early Claims

Any claims reported in the first 3 years of the policy (from the date of policy issuance) are called Early Claims and insurance companies will be carrying out a detailed investigation to ensure the genuine nature of such claims (unless there is a genuine reason for a claim like death due to an accident). If it is found that the policyholder has deliberately suppressed material facts at the time of taking the policy, such claims will be repudiated. But after the first 3 years, the claims are called Non-early Claims and they cannot be rejected. Why non-early claims can not be rejected, because of Section 45 of the Insurance Act.

Section 45 of the Insurance Act, 1938 – Indisputability Clause

As per IRDAI- No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy, i.e. from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of rider to the policy, whichever is later.

That means your claim cannot be rejected by the life insurance company after 3 years of risk commencement, issuance of the policy, or revival of the policy, whichever is later.

Why Claims are rejected?

It is up to you to select the Life Insurance Company of your choice. But Claim Settlement Ratio alone should not be the criteria for deciding the company.

Let me explain with an example:

Mr. X has purchased a Term Policy of Rs. 50 Lakh from a private company. This private company was not having a high Claim Settlement Ratio, as per the IRDA data. Since he is a diabetic, he disclosed his health condition. He has undergone the pre- medical examination arranged by the insurance company and his premium was loaded by around 20% from the normal premium quoted earlier. Unfortunately, he died within 2 years of taking the policy. His nominee got the claim because he had mentioned his health conditions correctly at the time of buying the policy. Had he not mentioned that his nominee would have been denied the claim after a detailed claim investigation by the company.

Now, imagine another situation:

Mr. X has taken a policy from the company with the highest Claim Settlement Ratio. Here, he has not disclosed his diabetic condition. What will happen, if there is a claim in the first 3 years like above? Will his nominee receive the claim? No, because each claim will be investigated separately and will be decided on the merit of each case.

What you should do while buying a policy?

If you fill up all the correct information while buying the policy, you need not worry about the Claim Settlement Ratio of the company. You have to read each question in the Proposal Form and answer it correctly to the best of your knowledge. There will be questions about your current health conditions, medication, family history of hereditary diseases, previous policies held by you, etc. Habits like smoking and drinking also have to be disclosed. There can be a pre-medical examination depending on the type of policy and its value. The insurance company will decide on each proposal based on the information given by you. If there is an adverse finding, the company will either charge a higher premium or reject the proposal.

You should fill the Proposal Form by yourself. Agents can definitely help you in filling the Proposal Form but never allow them to fill it by themselves by just putting your signature on it.

Claim Settlement Ratio – Reason to Worry?

If you are honest and disclose all the information while buying the policy, there is no need for you to worry about the “Claim Settlement Ratio” of insurance companies. Normally, all insurance companies will honor the genuine claims.

Or, you can approach the appellate forums like Insurance Ombudsman and Consumer Court to get justice.

The reason to worry is when you are hiding the material facts about your health, occupation, or your habits like smoking, etc. The chances of claim rejection become high.

Conclusion

Claim settlement ratio does not ensure settlement of term insurance claims. It should not be the sole reason for selecting a term insurance policy. Though it can be one of the reasons to select term insurance policy, a high claim settlement ratio may also mean that the company is doing due diligence in selecting their prospects.

There are other factors that need to be considered while selecting a term insurance policy, which we will discuss in later articles.

Points to remember:

- Declare all material facts while purchasing a Term Insurance policy.

- Do not select Term Insurance policy solely on basis of claim settlement ratio.